Wage Advance

Access your wage early

Get the money you've already earned, instantly.

* Terms and eligibility criteria apply. Subject to ongoing suitability checks. Representative APR: 43.61%. Representative example: Loan amount £108. Fixed fee: £8. Interest: 0%. Repayment period: 62 days. Total loan repayment: £108.

How it works

Once approved, it takes less than a minute for your money to get into your account.

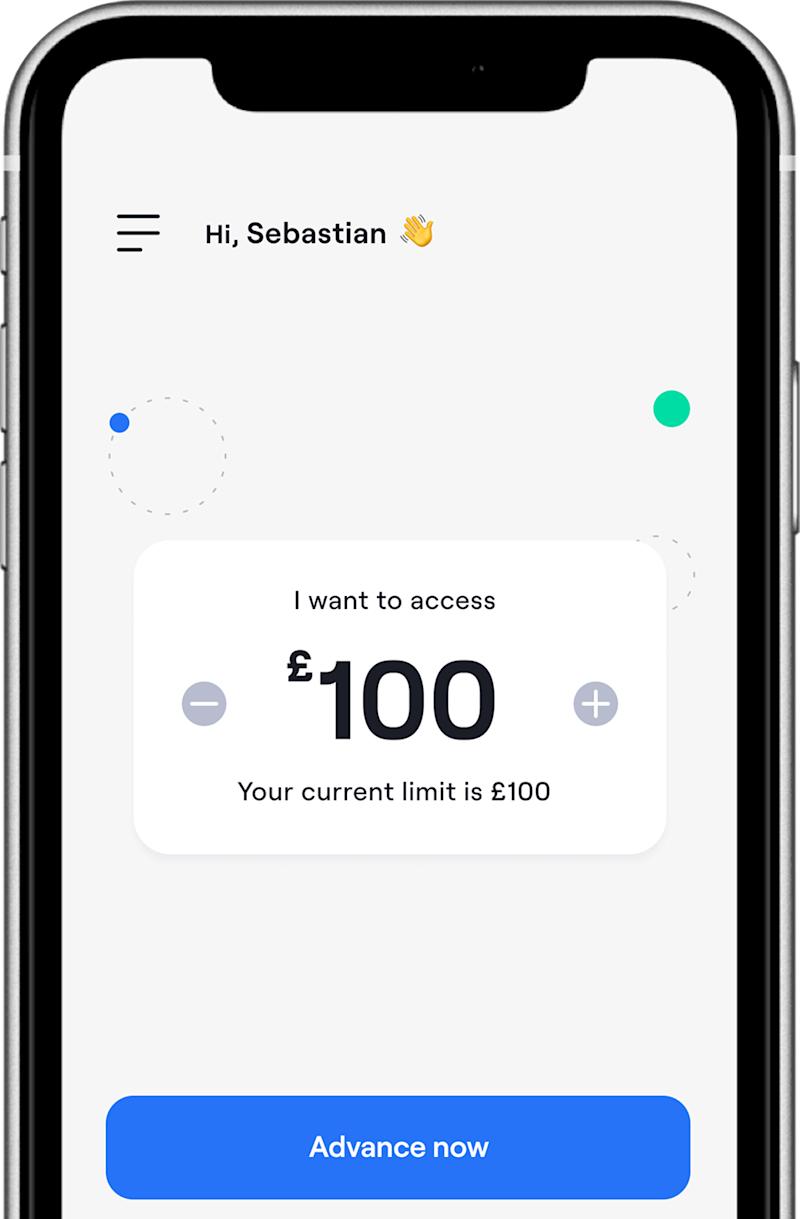

01

Choose your amount

The easiest way to get the money you've earned ahead of payday. Receive £100 of your pay as soon as you’re approved with us for a small, one-off, fixed fee. You can then just repay when you get paid!

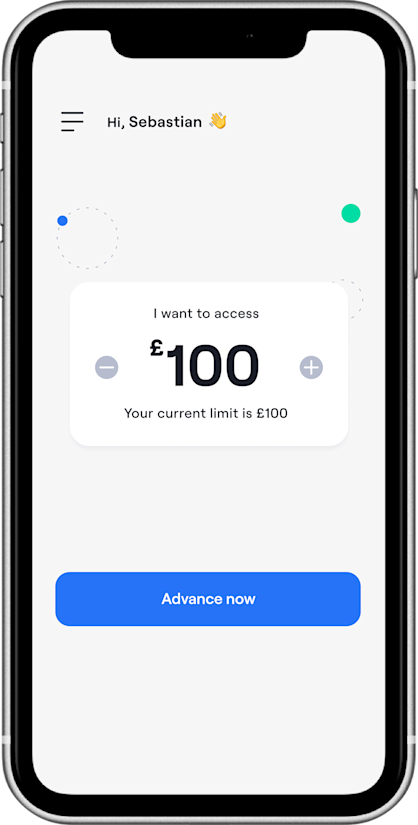

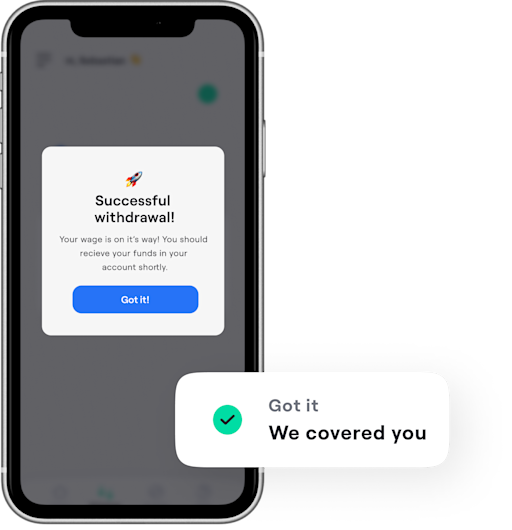

02

Get paid instantly

No long wait times; we know you need your cash pronto. As soon as you've hit 'Advance now', we send you the cash direct to your bank account. There isn't a faster way to get your pay now. While there are other fast cash options out there, like payday loans, they don’t get approved as quickly and often come with high fees. Wagetap simply provides you with the money you’ve already earned for a small, one-off fee.

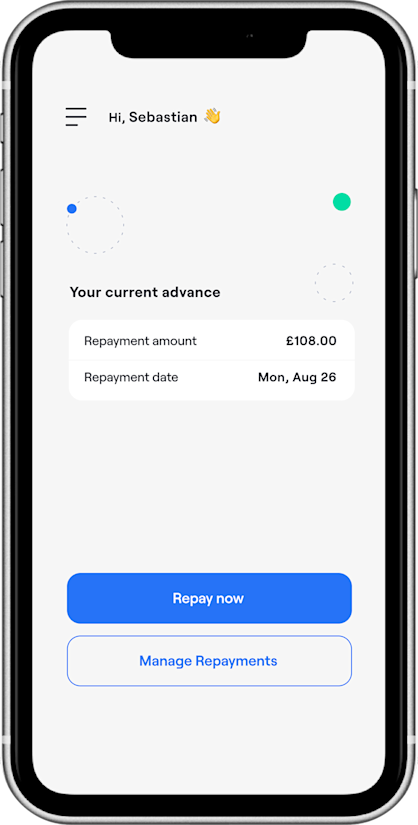

03

Repay on your next pay day

We pride ourselves on being transparent and fair with our repayments. No late or hidden fees. Cash out today, and repay on your next pay day! Repayment doesn’t have to be a stressful situation with Wagetap. Get the money you need, pay your expenses, and pay us back with no worries.

Wage Advance

How does wage advance work?

How often can I take an advance?

How much can I advance?

How much does it cost to take an advance?

What is the representative APR?

Can I get my funds instantly?

Why haven't I met the eligibility criteria?

- • You have not connected a transacting account that your wages are deposited into.

- • You don't meet the minimum income requirement (£500/week).

- • Your wages are not paid by your employer's payroll (not as bank transfers).

- • Your wages are not consistent, meaning you don't have at least three wage payments from the same employer weekly, fortnightly or monthly.

- • You have too many gambling expenses on your account.

- • You have too many dishonour fees on your account.

- • You have too many payment reversals on your account.

- • Your recent expenses and repayment history have not passed our eligibility criteria.

I’ve taken an advance before, why can’t I take another one?

How can I become eligible?

Am I Eligible?

See if you meet our lending criteria below

Who can access Wage Advance?

Access up to £100

You have connected a transacting account that shows your wages.

You have regular consistent wages, minimum of £870/week.

Your recent expenses and repayment history have passed our eligibility criteria.

See our full list of eligibility criteria in the FAQs. Please note: our criteria are subject to change.

See our full list of eligibility criteria here. Please note: our criteria are subject to change.

What customers are saying about Wagetap globally

© 2026 Wagetap All rights reserved

Wagetap is a trading style of Wagetap UK Limited, any references to Wagetap are references to Wagetap UK Limited, Company Registration Number: 16105377. Wagetap is an appointed representative of Creative Finance Corp LTD under reference FRN 1024314. Creative Finance Corp LTD is authorised and regulated by the Financial Conduct Authority under reference FRN 702435, and is the principal firm of Wagetap. Wagetap is a credit broker and not a lender. We facilitate credit agreements with our partners on our network.